Matthew 8:16-17 Authorized (King James) Version

16 When the even was come, they brought unto him many that were possessed with devils: and he cast out the spirits with his word, and healed all that were sick: 17 that it might be fulfilled which was spoken by Esaias the prophet, saying, Himself took our infirmities, and bare our sicknesses.

Fulfilment, Finished Work Theology

The Word & The Spirit Coming Together

Every Creature Commission TV

youtube channel

ECCTV FACEBOOK PAGE

FOR LIVESTREAM +

update: 01 MARCH 2026

MASSIVE WEBSITE - - HOVER FOR SUB MENUS

BEHOLD THEIR THREATENINGS

CONCERTED ATTACK AFTER ATTACK TO DESTROY THIS MINISTRY PARTICULARLY FROM WALES

We now face having to pay off this summons for "non-domestic rates" on a property in Barry, South Wales no present trustee has ever operated from, it being a mystery to us why we should pay this except under circumstance of threat which is what we face.

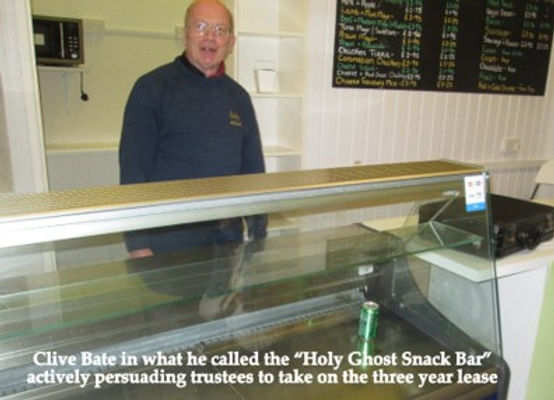

We point out that Vale of Glamorgan Council have been kind to us and given us time to pay but £6,020 - 84 must still be paid and so we would appreciate you taking this to our dear Lord Jesus - we forgive Clive Bate for getting us into this - he not replying to any of our mails for help.

Our story talks of assurances that were given by a former trustee. In addition to this we accepted our knowledge of civil law in relation to not having to pay such taxes when none of our equipment in the property was ours, thus making it empty of what we own - it being occupied by a former trustee for about four days it would seem, present trustees never being given the key to the property, so how could we possibly enter the property to create income? We have appealed to the Council on more than one occasion but receive no reply, except a summons and some phone calls.

There now follows our LATEST APPEAL TO THE COUNCIL ........

Acts 4:29 Authorized (King James) Version

29 And now, Lord, behold their threatenings: and grant unto thy servants,

that with all boldness they may speak thy word,

07/03/2024 12:30:13

EMAIL TO nndr@valeofglamorgan.gov.uk

LETTER TO: Revenues Manager

Vale of Glamorgan Council

Civic Offices

Holton Road

BARRY

CF63 4RU

Dear Sir or Madam

In reply to the summons of 01 02 24

Re 50 c Holton Road – 101543000

Court Summons Reference: 6873

Trustees of the above-named charity, David and Lindsay Griffiths plus Pamela Masih hereby agree that we are not liable for the non-domestic rates summons issued to us for the following legal, moral and ethical reasons.

OUR FULL REPORT THAT NOW APPEARS GIVES EVIDENCE WE BELIEVE OF A SET UP AND THAT WE AS UNPAID VOLUNTARY TRUSTEES SHOULD NOT BE LIABLE AT ALL FOR “NON-DOMESTIC RATES” but rather be compensated for the severe stress that this apparent business deal has caused us, particularly in view of the threats received by us in 2010 that we would be “destroyed through official channels”, threats that Solicitor Dylan Moore is aware of, as is a Senior CID Officer who warned us of them– “even though David you walk in high places, there are those in high places after you.”

We believe both the Council and the Court needs to be aware of this even within the context of our presentation of law that we are convinced clears us of all liability. We present our case:

-

The Vale of Glamorgan Council quoted Section 45 of the Local Government Finance Act, 1988 as apparent legal proof that rates were due on the quoted property, but all the assets of the Charity will be passed on thus making the Charity’s assets, properties and goods being set in place to pass on to those who will continue the work and vision of the Charity, as far as we are concerned forever. The designated gifts of many years must not be given over outside of their intended purpose. It is in this context the legal responsibility of trustees to protect these assets which we do from a basis of all staff being un-waged, the staff numbering three, two of whom being in our seventies and one on minimum wage working with special needs people for another Charity. Neither the Charity or the trustees of the Charity have savings and so a £6,000 “non-domestic” rates bill to us for a property no present trustee has ever worked from or taken money from is a huge pressure on us, and so ask for law to be applied here with “law and justice in mercy” as the Coronation Oath demands.

We pointed this out to the Council looking for dialogue on this but got a summons in return, which with respect we regard as a strange response. It is not as if this Charity although battling for funds in the context of so many of its givers passing away with the events of the last four years has any record of a court penalising it for not paying its bills, despite of us battling because of the events of the last few years.

We put to you that many charities are battling, but also put to you that we are very responsible when it comes to handling our finances being registered both in England and Wales and in Scotland. Each year the accounts are audited by a recognized Chartered Accountant in Wales and presented to the Charity Commissions both in England & Wales and in Scotland.

In this context we put to you that whenever you have issued a bill for “non-domestic rates” we have consistently challenged it and appealed against it being completely open and transparent with you being fully in line with the UK Nolan Principles of Government which both my wife Lindsay and me are fully familiar with having been voluntary councillors on Bay of Colwyn Town Council, I having been Chair of Policy and Finance where the aim was to help and give grants to charities rather than issues summons to a Court.

It is therefore our considered conviction that based solely on these grounds that no "non-domestic rates" are due, simply by placing the Council’s quote from the law in relation to the context on which it is given, noting the Charity’s assets will be passed thus placing them in the context of the hereditary requirement, many of the Charity’s assets having come from legacies thus placing them under the category of gifts having been giving in the hereditary context of times gone by as well as them being in line to be passed on in the future. We will not let the sacrifice of ourselves, and others be removed from us, and we believe the context of the law quoted from us protects us from this very clearly, the law therefore being ethical and moral. You quoted this law:

Section 45 of the Local Government Finance Act 1988 that says this:

In accordance with the provisions of section 45 of the Local Government Finance Act 1988 as amended by the Non Domestic Rating (Unoccupied Property)(England) Regulations 2008, the owner (ie the person entitled to possession) of an unoccupied non-domestic property is liable to pay 100% of the basic occupied business ...

Reading further on from your quote however we find this:

F145AUnoccupied hereditaments: zero-rating

(1)Where section 45 applies in relation to a hereditament, the chargeable amount for a chargeable day is zero in the following cases.

(2)The first case is where—

(a)the ratepayer is a charity or trustees for a charity, and

(b)it appears that when next in use the hereditament will be wholly or mainly used for charitable purposes (whether of that charity or of that and other charities).

https://www.legislation.gov.uk/ukpga/1988/41/section/45A

We have a copy of the relevant form in relation to charitable relief which we returned to David Seal of the Council dated 18th. January 2019. (OUR REFERENCE DOCUMENT 1)

Further legal support for our position is provided by the Charity Tax Group who intimate the following: Business rates – Property wholly or mainly used for charitable purposes

Charity ratepayers are granted a mandatory 80 per cent relief from non-domestic rates where the property is wholly or mainly used for charitable purposes by that charity or by that charity and other charities. They do not need to be a registered charity in order to claim the relief, but must be able to show that they are established for charitable purposes. A distinction is drawn so as to exclude from relief use for the purpose of getting in, raising or earning money for the charity.

https://www.charitytaxgroup.org.uk/tax/business-rates/property-wholly-or-mainly-used-for-charitable-purposes/#:~:text=Business%20rates%20%E2%80%93%20Property%20wholly%20or%20mainly%20used%20for%20charitable%20purposes,-See%20latest%20updates&text=Charity%20ratepayers%20are%20granted%20a,that%20charity%20and%20other%20charities.

Further to this we have taken relevant solicitors’ advice in relation to all of this and can quote from letters and in the latter case verbal advice. To be blunt The Charity and its trustees are in no position today to employ solicitors and barristers due to the cost and having lost so many of our givers due to the events of the last years. We continue united however and in line with the Nolan Principles will be completely transparent with you, looking to work with you and form relationship outside of legal threat. That is our aim.

-

Over the last week Trustee Pamela Masih contacted her brother who is a Solicitor. He informed her of the six-year rule when such matters like this are written off. There is also the custom of charities not paying business rates (seemingly now non-domestic rates) and also the custom when a property is empty there is no charges, the equipment in the shop belonging to the Landlord and not us!

There is also the principle that taxes should be paid on profit. Here we have suffered loss before even considering the £6,000 demand. We are now over six years.

This Solicitor also stated to Trustee Pamela Masih that within the context of the lease, there is a requirement on the Landlord to be actively involved looking to pass on the lease. The following witness statement from former tenant Carole Mackintosh most certainly questions that commitment, this we believe relieving us from obligation here. Her statement also relates to the activities of Clive Bate whose ordination with us was removed.

-

THE VALIDITY OF THE WHOLE LEASE OF THE SHOP has been questioned by Solicitor Dylan Moore of David Jones Solicitors, Llandudno. In a letter of 11th. March 2020 Solicitor Moore declares that he does believe in view of the circumstances that there does seem to have been a “close connection" between Clive Bate and the Landlord. (OUR REFERENCE DOCUMENT 2)

This suspicion of Dylan Moore, trustees believe to be confirmed by former tenant Carole Mackintosh in a communication with Solicitor Dylan Moore:

Carole MacIntosh, Former Tenant of the Shop

From: carole mackintosh

Sent: 16 March 2020 14:26

To: mail@davidjoneslaw.co.uk <mail@davidjoneslaw.co.uk>

Subject: 50C Holton Road Barry/Vince Driscoll

FAO of Dylan Moore

Good afternoon....I had a very interesting conversation with your client David Griffiths last week and he has asked me to send you any relevant information that could help your case regarding above property.

I was a tenant of the property from Feb 2014 until Jan 2018.I had a good business but decided to end it due to the stress being caused by Vince Driscoll. Since vacating he has continued to harass me. He claims I owe him money which I certainly do not. My last contact with him was about a year ago when I simply said via his solicitor Max Wooton of CJCH Thompson St Barry that I was not paying money I did not owe. Since Jan 19 I have been pursued by BES Utiiities for electric dated from 1st Feb 18. I vacated Jan 18. They have asked Vince for confirmation that I left property but he would not do this....eventually he lied and said I left Jan 19. I have informed BES there was a new tenant from approx March 18 and they have requested a copy of the lease. David tells me you can provide me with this which will be an amazing help as I am quite literally at my wits end with the hassle from this company.

I have read Davids link re your complaint against Vince/Clive/Council and would be happy to help in any way I can.

I can confirm business rates at zero....I paid nothing in 4 years. I can confirm that Vince will have stated that he would not hold you to a 3 year lease....just 2 months to find a new tenant as he said exactly the same to me. I live approx 50 yards from the property....there has been someone inside painting...I presume a new tenant. Two weeks ago the tall stand up drinks fridge had been put outside for collection by rubbish men.

In relation to the sale of the shops equipment from myself to your client then Vince was middle man. I paid Vince £3500 when I took lease for everything in shop.....this was apparently price asked by previous tenant. I did not question it. Vince told me your client offered to buy same items from me for £750. I refused however said I would accept £1000 as I really wanted to be done with the whole situation. David tells me that Vince charged him £1500 for equipment !

My final year at property was made increasingly difficult by Vince. I had called Welsh Water out and it came to light that I was paying the water bill for two other businesses in the building. Vince was aware of this. One had a sub meter but WW had not been taking readings and deducting....one had no sub meter and WW told Vince to put one in as it was his responsibility. He agreed but never did. I therefore made deductions from his rent to balance this. He became quite aggressive with me over this. The water heater broke....Vince said he would replace but didn't. Told me to get a new one and he would pay. He then never. Once again I deducted from rent. Vince had major grant work on outside of building. My shutters were removed but never replaced. When I questioned this with council Mr Viv Hinds-Payne told me Vince had said all tenants had said they no longer wanted them at a meeting he held. No meeting ever happened. No shutters affected my security and insurance plus let in a lot of heat....this caused problems with my large deli fridge failing ...more cost to me. Vince told me to sort blinds which I did.....again refused to pay bill so I deducted. Mr Hinds- Payne eventually refused to work with Vince as he was causing problems with him at council.

Vince is very well known in Barry but not for good reasons. He received a very hefty fine a number of years ago due to bad hygiene practices when he had the Fresh Bacon Company. Another tenant of his had him banned from entering his business due to hassle caused. He made headlines not so long ago when he opened dog kennels at his home in Dinas Powis without the relevant planning permission. He has numerous court cases over the years where he tries to sue people. He is locally known as a crook and a swindler. People that have done work for him are always chasing him for payment. He can be aggressive....threatened to ruin my business and run me out of town. I know of someone he offered money to to 'beat' another person. However he is a local councillor for the conservative party also!

In relation to Clive Bates....although I do not know the man well he had offices above shop for a number of years. I generally kept my distance as found him odd. The african lady he mentions as volunteering in his shop is a local lady called Rita. She approached me a while back asking what I thought of Clive as he had started attending her religous/community group but was not very popular with others. She said he had suggested taking a group of children to North Wales head office but she said CRB check would have to take place. He got angsty and refused ......very suspicious in my opinion. An elderly lady one dropped something into the offices for Clive (asked another tenant to pass on for her) he said she was very distressed and anxious to leave building without seeing him. When Clive had shop I would often see him sat in there although the shop never opened. Often there was boxes of vegetables and other foodstuffs/stock on counter.

I'm not sure how relevant any of this information is to you? But happy for you to call me if you have any particular questions. My number is 07970014995.

Regards

Carole Mackintosh

SUMMARY OF POINTS HERE AND OUR REPLY

This witness statement in our view illustrates LIES, LIES, LIES and UNDERHAND DEALING.

-

History here stated by a previous tenant – a testimony consistent with verbal statements to me (DPG) by Angela of Knights and Joe Turner.

-

A Drinks Fridge being thrown out – but we had paid £1,500 for this equipment minus a final payment of £333-33 which we had never paid – yet equipment we had partially paid for was being thrown out!

-

If this witness statement is correct Vincent Driscoll had lied to us and to Carole over the purchase of equipment running one against the other, we being assured by former Trustee Clive Bate of Vince’s honesty.

-

Carole gives account of inconsistency of Vince’s behaviour. We can see this in our dealings too combined with the assurances of Clive Bate, it is our position that we were conned into this lease.

-

Carole mentions a Mr Hinds-Payne who seems to have had difficulties with Vince.

-

Carole mentions the poor reputation Vincent Driscoll had and this is borne out by others in testimony to. The Wales On Line website gives a case of bad practice –

-

Carole goes onto declare gangster style tactics to beat others, we being a ministry who have had to endure threats in the past, on one occasion we having all the evidence on someone who was protected by the Irish “no prosecution” list and wonder whether this is the same here! There is a pattern coming here in the witness statements, of our experience, of Carole’s, of the statements of Knights Estate Agents, Joe Turner and so forth all going alongside an on-line reputation. Is has to be asked whether this man is protected as we have experienced in the past.

-

Carole makes two points of concern in relation to Clive Bate. Please note from the Charity-Ministry Clive Bate had received our ministry manuals in relation to conduct. We have a principle of operation that looks to bring the conditions for individual themselves to hear from God, not give words from “God” over what they should do. Our manuals are at https://www.thebiblecollegeofwales.org/bible-assemblies

We knew nothing of Clive Bate wanting to take children to North Wales, this seeming to be at a time after his meeting with Fanta Fofana, who we have heard has had her own children taken away by Social Services. We are deeply concerned about this and ask professional opinion over what we should do about these concerns.

It is clear that Clive Bate had taken an anti-nomian approach to our manuals, procedures and policies and so we removed his ordination from us. When asked who his ordaining body is now, he refused to answer except say which is a kingly title. It is our belief he operates now with a false title “Reverend” and we have proven still uses our Ministry name on the door of 50 Holton Road, this being the case as at Summer of 2019. We believe him to be a danger to vulnerable people thus our warning to government bodies who were advertising his services.

-

Carole gives evidence of vegetables/foodstuffs in the sandwich shop and we have record of such items being paid for on the charity credit card – but we have had no return on sales and do not know where the stock went.

-

24 02 18 CAROLE MACINTOSH confirms being threatened by utility firm BES for payments for a time we apparently hold the lease for.

A further witness statement followed from former trustee Barry Trayhorn, which proves without doubt that we never had a key to the property and so if we never had a key, how could we gain access to the property to make income to pay “non-domestic rates”. The keyholders were always Clive Stanley Bate and the Landlord and none of the property ever belonged to us for stock that was bought by Clive Bate was ever accounted for and the equipment of the Landlord in the shop ever paid fully by us. To quote Rev Trayhorn: Attitude towards the Charity shop was very disturbing. It was not open even though Clive Bate had the key, a key he has never handed over on resigning as a Minister and Trustee.

THIS MINISTRY HAS FACED LEGAL ATTACK AFTER LEGAL ATTACK - WE BELIEVE THIS SHOWING WE HAVE DONE SOMETHING RIGHT - WE ARE CALLING THE SAINTS TO COME TIGETHER WITH US TO CLEAR THIS WHOLE MATTER - PLEASE GIVE AS THE LORD LEADS -

Cheques to "BIBLE COLLEGE OF WALES" & posted to 25, George Street, Whithorn, Wigtownshire, DG8 8NS

Tel. 01492 544451; 07542 565415; 07542 565416; 07542 565417; E.Mail. ecctv4219@gmail.com

UK Tax Payers (Gift Aid Claim) may give offerings at

https://www.stewardship.org.uk/pages/24and25everycreaturecommissionappeal

INTERNATIONAL OFFERINGS BY PAYPAL:

THAT THE COUNCIL SHOULD LOOK TO NEGOTIATE WITH US, ANSWER OUR LETTERS BEFORE ISSUING SUMMONS ON UNPAID CHARITY WORKERS, none of whom have gained any money from the property in hand:

TO DAVID SEAL, 18 January 2021 we stated that we defend the Council’s demand for non-domestic rates ……….. on the following basis: that we as a charity never had keys for the property, the equipment inside not fully being paid for by the Charity, thus still owned by the Landlord, therefore surely the principle that if we have not put anything of ours in the property, then rates should not be owed; that on taking the lease we were told that there would be no such charges; that the previous tenant paid no such charges, and that we accept the witness from David Seal that the shop was open for a fortnight, it being run by Clive Stanley Bate, he having bought stock on the Charity Credit Card but gave in no income from the retail sales of that stock, failing to account for sales and providing receipts for expenditure contrary to the written policies and procedures of the charity.

Evidences:

We give simple statements of fact which seem to have been accepted from David Seal of the Council who has been sympathetic and helpful. He seems to have given his opinion that there is fraud here, and that we should take legal action, in my view it would seem he would prefer to pursue the rates from others rather than us. Our approach has been open and thorough keeping records etc., but with the events of the last four years we have not been able to afford to take legal action. Carole Macintosh, previous tenant, dated 16th. March, 2020. I can confirm business rates at zero....I paid nothing in 4 years.

Former trustee Clive S Bate stated on 01 03 18 emailed us an we trusted him:

PASTOR CLIVE S BATE <clive.cbchristian.bate@googlemail.com>

Thu, 1 Mar 2018, 00:32

to me

TO DAVE & ALL TRUSTEES OF LCMI,

I CONSIDER THAT AS NORMAL IN GOD'S PERFECT TIMING GOD HAS PROVIDED A

MASSIVE OPPORTUNITY TO INCREASE OUR INCOME FLOW AND AT THE SAME TIME

REACH MANY MORE SOULS WITH THE BEAUTIFUL GOSPEL OF THE LORD JESUS

CHRIST.

WITHIN THE BUILDING , HOLTON HOUSE, FROM WHICH WE MINISTER CURRENTLY

TO THE WHOLE WORLD AND AT THE SAME TIME DECLARING THE SOVEREIGNENTY OF

THE KING OF KINGS WHO IS LORD OF LORDS OVER BARRY, WALES , THE UK AND

THE WHOLE WORLD AS WE ARE OBEDIENT TO MARK 16: 15 PUSHING EVER FORWARD

WITH THE VISION OF REES HOWELLS.

THE PROPERTY THAT IS AVAILABLE TO US YOU HAVE PHOTOGRAPHS OF AND IT

HAS 2 FLOORS WITH A GROUND FLOOR ENTRANCE AND EXIT TO THE SERVING AREA

FOR THE PUBLIC PLUS A SEPARATE EXIT. THERE IS ALSO A LARGE FOOD

PREPARATION AREA AND BOTH THE SERVING AREA AND THE FOOD PREPARATION

AREA ARE VERY WELL EQUIPPED. IT ALSO HAS A TOILET. IT CURRENTLY HAS

THE HIGHEST HYGEINE RATING WHICH IS 5.

THERE IS A LOT OF DEMAND FOR THIS PROPERTY SINCE 4 PEOPLE ARE AFTER IT

ALREADY ACCORDING TO VINCE THIS LUNCHTIME.

VINCE WOULD PREFER US TO RUN THE CATERING OPERATION AS HE KNOWS US AND

KNOWS WHAT WE DO.

THE DEAL THAT OLD SCHOOL VINCE IS OFFERING THE CHARITY IS A WEEKLY

RENT OF £146.00 WITH AN UP FRONT PAYMENT OF 4/5 WEEKS FOLLOWED WITH

RENT OF 146.00 BEING PAID WEEKLY ON A 2 YEAR OR LONGER LEASE AS TO OUR

CHOICE. IT NEEDS TO BE CONSIDERED THAT A LONGER TERM LEASE PROTECTS

OUR CHARITY FROM RENT INCREASES AND CAN FETCH A BETTTER PRICE IN THE

MARKET PLACE, HOWEVER I WOULD SAY THAT THIS IS NOT A MAJOR

CONSIDERATION SINCE WE HAVE ESTABLISHED AN EXCELLENT RELATIONSHIP WITH

VINCE.

VINCE HAS ALSO SAID THAT TO HELP US SHOULD WE HAVE PROBLEMS HE IS

WILLING TO CANCEL THE LEASE AS LONG AS WE GIVE HIM 2 MONTHS TO FIND

NEW TENANTS. WE COULD SAY THAT VINCE IS A BETTER FLEXIBLE FRIEND THAN

A CREDIT CARD.

VINCE IS PURCHASING ALL THE CATERING EQUIPMENT FROM THE FORMER TENANT

FOR £1,500.00. HE NEEDS US TO PAY HIM THIS AMOUNT TO TAKE OWNERSHIP OF

THIS EQUIPMENT WHICH IS IN VERY GOOD ORDER. TO HELP US WITH OUR CASH

FLOW VINCE IS WILLING TO ACCEPT PAYMENT BY INSTALMENTS.

THE BUSINESS RATES ARE BETWEEN £5.00 AND ZERO PER MONTH.

THERE IS NO GAS AND I AM ASSURED THAT THE ELECTRIC IS QUITE AFFORDABLE

ON A VERY AFFORDABLE TARIFF.

THE ITEMS WE CAN SELL TO MAKE PROFIT ARE PORRIDGE, SANDWICHES,

SOUP, RED BUSH NATURALLY CAFFEINE FREE TEA, HOT PUDDINGS AND ICECREAM

ALL AT A £.

A BORN AGAIN CHRISTIAN INTRODUCED ME TO HIS DAUGHTER WHO RUNS THE CAFE

IN THE MARKET AT BESSEMER ROAD IN CARDIFF WHO THEN INTRODUCED ME TO

HER OLD SCHOOL WHOLSALER, TONY WHO WAS REALLY EXCITED ABOUT ME

PROVIDING SIMPLE HEALTHY FOOD AND THERE WAS NOBODY IN THIS MARKET SO

WE WOULD BE PIONEERING THE INTRODUCTION OF SIMPLE HEALTHY FOOD LIKE

THE OLD SHOOL STEWS AND SOUPS.

OUR COSTS WOULD BE MINIMAL ESPECIALLY AS WE WOULD BE USING VOLUNTEERS.

CONTAINERS FOR BEVERAGES CAN BE PURCHASED AT £1.95 - £3.00 PER SLEEVE.

GROSS PROFIT MARGIN SHOULD RANGE FROM 50% TO 80%.

WITH SPREADING THE KJV WORD OF GOD WE WOULD BE ABLE TO SPEAK DIRECT TO

CUSTOMERS, GIVE OUT LITERATURE, PLAY MEDIA AND SHOW VIDEOS PLUS

EDUCATE THROUGH POSTERS.

I BELIEVE TAKING ON THIS ENTERPRISE WILL ENABLE US TO DO MUCH MORE

GIVING OUT THE GOSPEL AND ENABLE US TO BE ON A MORE SOUND FINANCIAL

BASE AND BE WELL PLACED FOR FUTURE EXPANSION.

VINCE HAS SUGGESTED THAT THE CHARITY GIVES HIM A SMALL FLEXIBLE

REFUNDABLE DEPOSIT SO THAT THE PREMISES ARE OURS AND HE WILL NO

LONGER NEED TO DEAL WITH THE GROWING QUEUE OF COMPETITORS TO OURSELVES.

SHALOM, VICTORY AND BLESSINGS

Clive

REV CLIVE S BATE

3. ETHICAL – The Nolan Principles of Government

The one written reply we have from you in relation to your case, Section 45 of the Local Government Finance Act 1988 that says this:

In accordance with the provisions of section 45 of the Local Government Finance Act 1988 as amended by the Non Domestic Rating (Unoccupied Property)(England) Regulations 2008, the owner (ie the person entitled to possession) of an unoccupied non-domestic property is liable to pay 100% of the basic occupied business ...

However, if we look at the act, we gain the context in Section 45A which makes sense of the law for in the logic given by yourselves quoting section 45 then we have to pay 100% non-domestic rates but if we read a little further, the obvious context is given which is the following for charities:

Unoccupied hereditaments: zero-rating

(1)Where section 45 applies in relation to a hereditament, the chargeable amount for a chargeable day is zero in the following cases.

(2)The first case is where—

(a)the ratepayer is a charity or trustees for a charity, and

(b)it appears that when next in use the hereditament will be wholly or mainly used for charitable purposes (whether of that charity or of that and other charities).

(3)The second case is where—

(a)the ratepayer is a registered club for the purposes of [F2Chapter 9 of Part 13 of the Corporation Tax Act 2010] (community amateur sports clubs), and

(b)it appears that when the hereditament is next in use—

(i)it will be wholly or mainly used for the purposes of that club and that club will be such a registered club, or

(ii)it will be wholly or mainly used for the purposes of two or more clubs including that club, and each of those clubs will be such a registered club.]

It breaks all the principles of government to charge 100% for a charity’s unoccupied property and give 80% deduction for an occupied property for tax needs to be paid on gain, not loss and we have lost enough on this property claiming the lease to be illegal and claiming in context of the past that we were set up. Narrow use of law must be replaced by law in context and Section 45A does that!

There are so many other factors too in relation to this case:

i) As A Charity – Christian Ministry we have never entered the property with the exception of a person called Clive Bate of 10 St Hilary Court, CARDIFF, CF5 5EF, an apparent friend of the owner of this building who walked out on us when I was in ministry in the DR Congo in 2018.

ii) None of the fittings and equipment in the premises ever belonged to us.

iii) It has been a custom of many years for charities to have ZERO charge for commercial premises particularly prevalent when a charity has no income from a building as we have not.

iv) The 2023 Context – after having had so many of our givers die over the last three years and our income severely affected, your demands have placed a great strain on trustees, our whole story in relation to the premises in question being at https://www.ecctv.org/18-19-part-15 Brian Mason mentioned in the piece has now passed away, Lindsay is now 75 and I am 70. We have dedicated our lives to this cause and the sum you are demanding from us is beyond our thinking. The story clearly shows in our view that we were set up causing us immense stress we need at our age to be free from. We have a witness statement from a previous tenant that in our view clearly backs up our case.

v) The Lease in question has been questioned by a lawyer as to its legality, the said lawyer advising us not to pay more funds out in relation to these premises.

vi) Services given to us by your Council = NIL

vii) War Veterans: we have in our Christian Ministry experienced the systems of society break down and we see signs of it here. Our Ministry worked both with the Sri Lankan Government and the Tamil Tigers during the Civil War in Sri Lanka to bring relief to ordinary people suffering. Our Christian Ministry was appreciated by both sides. All countries of the UK are under major strain and the people are suffering here now, overzealous application of law adding to these stresses, so we ask for mercy here in line with our constitution that demands law be applied with “law and justice in mercy”, we believing we have an excellent case as regards to the “letter” but what is more important is the spirit.

viii) May I quote a previous tenant of the property who I can name who wrote to me in writing saying I can confirm business rates at zero....I paid nothing in 4 years. I can then ask why is it that a previous tenant who occupied the property and took income from the property is charged NIL whereas we as a charity of voluntary workers are being charged about £6,000? I put to you that this makes no sense, however the context of the law you quote relates the ZERO figure very clearly in our view!

In conclusion, may I quote two American statesmen in relation as to how government needs to be run:

“Health, learning and virtue will ensure your happiness; they will give

you a quiet conscience, private esteem and public honour.” Thomas Jefferson

Together, let us make this a new beginning. Let us make a commitment to care for the needy, to teach our children the values and the virtues handed down to us by our families, to have the courage to defend those values and the willingess to sacrifice for them. Let us pledge to restore, in our time, the American spirit of voluntary service, of cooperation, of private and community initiative, a spirit that flows like a deep and mighty river through the history of our nation. Ronald Reagan

Now we have no money to defend ourselves in court if you take this further, but we have something very precious as President Reagan encouraged in America, we ask you to encourage it in all the counties of the UK and that is the single word “virtue”.

Without God, there is no virtue because there is no prompting of the conscience... without God, there is a coarsening of the society; without God, democracy will not and cannot long endure. Ronald Reagan

What we are guilty of is dedicating our lives to voluntary service, defending the traditional values of all countries of the UK, and moving in the deep and mighty river of the times our nations have understood and grasped the first line of our written constitution that declares to “increase virtue in Christ’s Religion.” (1534 Act of Supremacy.) It is from this country the Americans received this virtue!

We believe there is no “virtue” in pursuing those who have lived sacrificial lives even to the point where we as a Ministry have crossed minefields and entered a hospital without doctors, nurses, and medicines to bring relief.

We believe we are exempt from the law you have quoted to us but more importantly is not the “letter of the law” but the “virtue” of it and it is this “virtue” we primarily declare as our preeminent defence.

PAST LETTERS OF WHICH WE DO NOT GET SPECIFIC REPLIES IN WRITING

LETTER OF 18 09 23 except 1 email shown from you

Dear David Seal or Sir/Madam

Re 50 c Holton Road – 101543000

I enclose the alleged copy bills for “Nondomestic” Rates on a property this Charity never occupied, never took money from, never had any of our equipment in and thus we firmly believe we are not liable for any of the alleged charges you send.

We never have used any of your Council’s facilities but for the interest of transparency we have already appealed vigorously your alleged charges and put the full story online of how our Christian Ministry has been targeted over many years within the context of the cancellation of our Christian heritage in each of our four nations.

As regards to this case – here is the link entitled “THE SET UP IN SOUTH WALES”:

https://www.constitutionkeepers.org/6-the-set-up-in-south-wales that has a further link to the full story:

https://www.ecctv.org/18-19-part-15

We hold witness statements of a set up here from a previous tenant of the property and are very open to tell our story directly to the Council – but the information we would give is available publicly online.

We believe it breaks all convention to attempt to push a Charity for what to us is a huge amount of money for services we have never used or entered, there in our view being persons who set us up!

Please find the last communication to your David Seal, who always dealt with us with great dignity and in our view was very sympathetic to what we have been through over this. We simply want this pressure removed, the last years running a Charity as unwaged workers having been difficult enough, we are believing our nation’s (we are still all UK) protects us from all of this.

As you see from the following, we also took legal advice that clearly informed us that as a Charity we should not be paying out funds in relation to the activities of what we believe to be a rogue trustee who did not keep our stated policies and procedures.

LETTER OF 01 03 21

01/03/2021 10:53:43

David Seal Esq.,

Revenues Manager

Vale of Glamorgan Council

Civic Offices

Holton Road

BARRY

CF63 4RU

Dear David

Re 50 c Holton Road – 101543000

Happy St David’s Day!

Simply to let you know, we are awaiting response from our solicitor Dylan Moore on what is clearly a complex situation but one that requires all involved to understand assurances given to us before the signing of any lease that have not been fulfilled.

Yours sincerely

David P Griffiths

Trustee and Minister.

COPY OF LAST LETTER THAT STILL APPLIES

LETTER OF 19 01 21

19/01/2021 09:20:53

David Seal Esq.,

Revenues Manager

Vale of Glamorgan Council

Civic Offices

Holton Road

BARRY

CF63 4RU

Dear David

Re 50 c Holton Road – 101543000

Simply to update you concerning progress in relation to our dealings with this property.

Trustees have just passed a proposal to issue instructions to

Dylan Moore,

Solicitor

David Jones Solicitors,

22 Trinity Square,

Llandudno,

LL30 2RH.

These instructions cover four organizations that relate to this property that include the Vale of Glamorgan Council. We have put the following points to our Solicitor in relation to our dealings with you and these are:

-

That as a registered charity, it is not customary to have to pay full non-domestic rates on property used for non-profit purposes. Indeed, in Scotland we have a shop used as a studio, the local regional council giving us 100% relief so we can prove a custom here.

-

We as a charity never had keys for the property, the equipment inside not fully being paid for by the Charity, thus still owned by the Landlord, therefore surely the principle that if we have not put anything of ours in the property, then rates should not be owed.

-

That on taking the lease we were told that there would be no such charges.

-

The previous tenant paid no such charges.

-

We accept the witness from David Seal that the shop was open for a fortnight, it being run by Clive Stanley Bate, he having bought stock on the Charity Credit Card but gave in no income from the retail sales of that stock, so if rates are due, it should therefore be paid from the income taken by Clive Stanley Bate.

Your willing to talk through these issues with us is so appreciated, trustees believing that the employment of our Solicitor will certainly move things along not only with the Council but also with other organizations and an individual involved.

Yours sincerely

David P Griffiths

Trustee and Minister.

LETTER OF 25 09 20

25/09/2020 15:06:34

The Revenues Department

Vale of Glamorgan Council

Civic Offices

Holton Road

BARRY

CF63 4RU

Re. 50C Holton Road

Your Ref 101543000

Further to your recent invoices in relation to non-domestic rates. The whole matter relating to an apparent lease on this building by this charity is now under legal review by our Solicitors. As a charity we are questioning the legality of the lease, and our liability to pay for it.

The solicitors dealing with this matter are David Jones Solicitors, 22 Trinity Square, Llandudno LL30 2RH. The Solicitor dealing with matters relating to this lease for us is Dylan R. Moore.

We have in previous communications laid down our position and this remains.

We appreciate you telling us that Clive Stanley Bate had opened the shop for two weeks. He was working on his own here without trustee approval and we understand runs a ministry of his own still using the name of this charity on occasions as we can prove. This does not place this charity liable, however, and so our Solicitor will be looking at the angle too.

It is quite a situation to take on and ask for your patience with us and it is all sorted out.

The address of Clive Stanley Bate who could well be responsible is 10 St Hilary Court

CARDIFF, CF5 5EF. It could well be as it is he who bought stock for the shop, he who opened it for the two weeks without trustee approval and it being him who convinced us to sign the lease, then walk out on us giving us assurances he did not keep – then it could well be him who is liable – hence the legal review.

We ask you therefore to hold back. We will communicate with you on progress.

Yours sincerely

David P Griffiths

Trustee

REPLY FROM YOU 15 05 20

Non Domestic Rates A/C: 101543000

Inbox

x

Non Domestic Rates

11:38 (14 minutes ago)

to me

Good morning,

Further to the correspondence received 08.04.20 and confirmation from your landlord that Life Changing Ministries International’s liability at the premise has ended 11.03.2020, I am writing to advise closing notices were issued 13.05.2020 to 25 George Street, Whithorn, Wigtownshire, DG8 8NS. The final balance is £6007.07 and is broken into each financial year as follows:

06.03.2018 – 31.03.2018 £56.23

01.04.2018 – 31.03.2019 £2331.35

01.04.2019 – 11.03.2020 £3619.49

You have already been issued with the bills for each of the periods above, to date no payment has been received.

As previously advised, you are liable for business rates as the leaseholders for the premise. Empty rates are payable by Life Changing Ministries International as the premise has been unoccupied. Empty rates are payable on all unoccupied properties under the Section 45 of the Local Government Finance Act 1988.

The liability of a previous ratepayer has no bearing on your liability to pay Business Rates, particularly as the circumstances are not similar.

Please arrange payment of the final balance as a matter of urgency. If you are not in a position to pay the balance in full, I am in a position to offer Life Changing Ministries a payment arrangement on the final balance. Please advise if you would prefer to discuss an alternative payment arrange,

I trust this clarifies the position.

Kind regards,

Miss Lauren Collins

Senior Revenues Assistant / Uwch Gynorthwyydd Refeniw

Resources / Adnoddau

Vale of Glamorgan Council / Cyngor Bro Morgannwg

tel / ffôn: 01446 709299

e-mail / e-bost: nndr@valeofglamorgan.gov.uk

Consider the environment. Please don't print this e-mail unless you really need to.

Ystyriwch yr amgylchedd. Peidiwch ag argraffu'r neges hon oni bai fod gwir angen.

Visit our Website at www.valeofglamorgan.gov.uk

Ewch i'n gwefan yn www.bromorgannwg.gov.uk

Find us on Facebook / Cewch ddod o hyd i ni ar Facebook

Follow us on Twitter / Dilynwch ni ar Twitter

Correspondence is welcomed in Welsh or English / Croesewir Gohebiaeth yn y Gymraeg neu yn Saesneg.

Non Domestic Rates

11:53 (0 minutes ago)

to me

PLEASE DO NOT REPLY TO THIS MESSAGE – THIS IS AN AUTOMATIC RESPONSE TO ACKNOWLEDGE RECEIPT OF YOUR EMAIL.

In light of the coronavirus measures introduced by the Prime Minister the Business Rates Department is currently closed for telephone calls and in person appointments.

We will endeavour to respond to your e-mail as soon as possible.

We are currently experiencing high volumes of business grants applications consequently responding to your enquiry may take longer than normal.

Further information regarding the Welsh Government Business Support Grant can be found on https://www.valeofglamorgan.gov.uk/en/working/Business-Support/Business-Support.aspx.

If you wish to make an application for a Business Support Grant you can complete an application online using https://forms.valeofglamorgan.gov.uk/en/businessgrants

We apologise for any inconvenience caused and appreciate your understanding at this difficult time.

Thank you.

PEIDIWCH AG YMATEB I'R NEGES HON – MAE HWN YN YMATEB AWTOMATIG I GYDNABOD DERBYN EICH E-BOST.

Yn sgil y mesurau coronafeirws sydd wedi eu cyflwyno gan y Prif Weinidog, mae'r Adran Ardrethi Busnes ar gau ar hyn o bryd ar gyfer galwadau ffôn ac apwyntiadau wyneb yn wyneb.

Byddwn yn ymdrechu i ateb eich e-bost cyn gynted ag y bo modd.

Rydym yn cael llawer iawn o geisiadau grantiau busnes ar hyn o bryd ac o ganlyniad gallai ymateb i'ch ymholiad gymryd mwy o amser na'r arfer.

Ceir rhagor o wybodaeth am Grant Cymorth Busnes Llywodraeth Cymru ar https://www.valeofglamorgan.gov.uk/en/working/Business-Support/Business-Support.aspx.

Os ydych yn dymuno gwneud cais am Grant Cymorth Busnes gallwch gwblhau cais ar-lein gan ddefnyddio https://forms.valeofglamorgan.gov.uk/en/businessgrants

Ymddiheurwn am unrhyw anghyfleuster ac rydym yn gwerthfawrogi eich amynedd ar yr adeg anodd hon.

LETTER OF 08 04 20

08/04/2020 09:18:40

Miss Lauren Collins

Senior Revenues Assistant

Vale of Glamorgan Council

Civic Offices

Holton Road

BARRY

CF63 4RU

Dear Miss Collins

Re 50 c Holton Road – enclosed bill

Further to my recent letter to you of 18 03 20, I hereby inform you that we are conducting an inquiry into the whole situation around 50 c Holton Road.

A number of witness statements have been given including one from a previous tenant of four years stating that she paid no rates on the property for four years, running it as a business.

I can confirm business rates at zero....I paid nothing in 4 years.

This is in contrast to us as a Charity who have never had a key to the property, have put nothing into it, taken no money but has cost us thousands of pounds to the landlord, thus preventing us from our building project in Sri Lanka where the money is desperately needed in the context of a developing world country. We have no paid staff running from committed volunteers, yet we are being charged £10,132-88. We have not used any of the Council’s Services simply because we have never opened the shop.

This bill comes at a time when two of our full time staff here have been told to stay in for health reasons by Dr Hilliard of the Whithorn Surgery, and the other full time member is 71 so legally we could not come down and open the shop and take money for you anyway.

The inquiry is looking at the legitimacy of the lease. Our Solicitor and Accountant in this matter are:

Dylan Moore, David Jones Solicitors, 22 Trinity Square, Llandudno, LL30 2RH - 01492 874336

Zoe Devenport, Henry R Davis & Co Ltd, 33 Chester Rd W, Queensferry, Deeside CH5 1SA 01244 831277

-

LCMI Trust Accountants

As former councillors in Wales my wife Lindsay and I are aware of the Nolan Principles of Public Life, which we can prove as Councillors we passionately kept to. We therefore ask that all parties involved in this matter express an honesty, openness and transparency that the Nolan principles demand.

Yours sincerely,

David P Griffiths

Trustee and Minister

LETTER OF 18 03 20

18/03/2020 14:07:10

Miss Lauren Collins

Senior Revenues Assistant

Vale of Glamorgan Council

Civic Offices

Holton Road

BARRY

CF63 4RU

Dear Miss Collins

Re 50 c Holton Road

Further to my letter of 10th. March 2020 in relation to apparent business rates on this property that we have never entered or had any money from.

Our appeal is not only on business terms but is also on humanitarian terms too. The latest is our Charity H/Q in Scotland on which we pay no business rates is on lockdown, two of our trustees here being classed by medics as high risk. This means we cannot come down to South Wales and defend ourselves.

LATEST NEWS …..

-

We understand that the property on 1st. March is being taken over, although this very serious virus may have affected this.

-

We reject your bill of 13 03 20 for a further £3,950 as being remotely legal not only for the reason which we have given but also in view of government policy in relation to business rates, we of course not being a business. You are claiming from a charity in £10,132-88 on a property we have never entered or used any council service for.

-

Dylan Moore, Solicitor of David Jones Solicitors, 22 Trinity Square, Llandudno LL30 2RH is dealing with Cllr Vincent Driscoll over the lease, we disputing our responsibility for it, we having written a detailed report that you have.

-

Our previous letter gives clear indication of us being threatened in 2010 in relation to targeting against Christian ministries. We firmly believe this is the case here particularly as we have witness that the previous holder of the property for four years was not charged one penny in rates, and she was taking income and had the keys. Can you please then substantiate your case for business rates (we know they are now called non-domestic rates – but business rates they are) when she was charged nothing who was taking money and we have been charged over £10,000 when we have taken no money. As a former Councillor in Wales I can only say I have never heard of such a thing.

We have heard from another Christian ministry in South Wales in relation to targeting. I have contacted all your councillors including Barry Town Council about these expecting replies but I have not one! Can you explain why this is for as a Councillor I used to act on matters given to me!!!!!!

Finally, our trustees here are all over 65, two 70 and over. We are facing lockdown here and have enough pressures to deal with without having a bill for over £10,000 we cannot pay for an area where we do not live.

May I humbly suggest that this is a time of major pressure on the nation, that we all look to work together. The issue is being dealt with as regards the lease by our Solicitor who can be contacted. Can we allow for this to be dealt with, look for the lease to be passed on, then deal with this issue?

You have a copy of the story. It is a very unusual one. I believe it right that the old constitutional demand of “law and justice” in mercy come into play here. Don’t you?

COPY OF PREVIOUS LETTER – LETTER OF 10 03 20

10/03/2020 11:07:31

Miss Lauren Collins

Senior Revenues Assistant

Vale of Glamorgan Council

Civic Offices

Holton Road

BARRY

CF63 4RU

Dear Miss Collins

Re 50 c Holton Road

Following is our appeal against your threat to take “recovery action” against us, against the invoicing of non-domestic rates on a shop we have not even had the keys for, our appeal placing your injunction alongside a line of un-constitutional legal attacks over the last ten years, attacks in line with threats placed on us by text that have resulted in what are often crazy actions against us.

We trust you study this appeal in great detail, our appeal going too – to your democratically elected councillors in view of gaining support for the notion that in this case – spirit can take preference over letter, a centuries old principle in the history of our nation.

“Charitable Appeal to

Vale of Glamorgan County Council”

“[or, are the threats given by text in 2010 ‘to destroy us through the proper channels’ really going to succeed?]”

“‘Witchcraft’ is a word rarely used in today’s ‘politically correct’ society. Simply put, it is an activity that brings destruction, rather than life.

“The group that threatened to destroy us in 2010 - & we still have the text messages – (3 featured above) are a group strongly connected with what is known as ‘church’ in Wales.

“Since 2010, this ministry has had to endure legal attack after legal attack, with an eye to destroy rather than bring life. This Charity is about bringing life rather than death, destruction being something alien to the aims given in our Declaration of Trust in 1997. Yet from 2010, we have had to face legal threat after legal threat, (in line with the text threats) & added to these is the recent threat from Vale of Glamorgan County Council that if we do not pay them funds for apparent non-domestic rates, over £6,000, then recovery action will be taken against us.

“If this was the only action since 2010, then all would be well; but we as a ministry, with loyal trustees who have given their all, have looked constantly to keep the law. But there comes a time when it has to be said, ‘the letter of the law killeth, but the spirit giveth life.’

“This whole ethos has been entrenched in British law for centuries, from the Elizabethan Settlement. Do we not find that laws passed by the British Parliament use the term ‘spiritual & temporal’? So, can we not realise that in British law, the spirit is above the temporal? So, in our appeal to Vale of Glamorgan County Council, can we not say that further legal action against this Charity that has stood for righteousness, justice & fair play, would be one of extreme harshness, particularly when the premises in question, charitable Trustees have not even had a key for, or even used, or received any funds from sales at that premises? (could it be we have been set up in line with the text threats – please see enclosed story of the shop – 50c Holton Road)

“How can a Charity, therefore, be taxed under British law that keeps to the original tenets of the Elizabethan Settlement?

“Today, it can be argued that Wales has its own Assembly, the Senedd, Wales today making its own laws; but surely a Senedd has to understand the Christian history of Wales? It is one thing to wave the flag of David, & another thing to destroy those who uphold the principles of David’s ministry in Wales by the letter of the law that killeth, rather than uphold the spirit that giveth life. (All that is doing is bowing down to the text threatener who vowed to destroy us through official channels – it is now 2020 – we have survived ten years of these attacks)

“who also hath made us able ministers of the new testament; not of the letter, but of the spirit: for the letter killeth, but the spirit giveth life.” [2 Corinthians 3:6]

“The whole history of the shop at Barry, we have given in our last Annual Report, the relevant passage being in Part 15, available on-line at https://www.ecctv.org/18-19-part-15 and in the enclosed.

“It is firmly the belief of present Trustees that a former Trustee who took on this Lease, actively encouraging us to sign it, giving us assurances there would be little or no non-domestic rates to pay, was infiltrated by those connected to this witchcraft group that promised to destroy us in 2010. His actions bear little resemblance even to human rationale, more effectively showing to us a lack of awareness of the group that promised to destroy us in the texts of 2010.

“One such method of this group - & churches all over Wales are being affected by this – is the common practice, particularly in charismatic circles, of giving ‘words from God’, so as to take people out of their godly calling, & leaving charities like ours in great difficulty.

“We therefore appeal to Vale of Glamorgan County Council to read our story about the shop at Barry & how it came about; & to take seriously the consequences of taking legal action against us.

TEXT 2

You make me laugh 25 years in the ministry a congregation of 8 but I will have the last laugh how sad

19:56:16

+447594295413

TEXT 3

I have done my background information on your so called church every minister I have spoken to think you are a disgrace and wired to the moon just look at yourelf ruining peoples lives all for the sake of I wonder why well good night mr gracious with 11 law actions I tell you something you have ruffled my feathers you are going to be totally plucked when I have finished with you and your joke of a church

21:08:51

+447594295413

TEXT 6

Hh dave my mission is to destroy your cult along with (a named former trustee who has had serious mental breakdown as in my view a result of these threats) through the proper channels sue me if you dare

22:35:46

+447594295413

Miraculously this has now been built and producing great fruit

“We have an affiliate College in Sri Lanka that, like us, has had many actions of witchcraft come against it. On the grounds of this College, we have been building our own Mission House so as to build up the faith of those who call themselves Christian, in lands of great persecution.

“As a ministry, we do not persecute others. Indeed, it is our record that we show the love of Christ Jesus all over the world, even to the point of blessing those who curse us, a Christian ministry connected to us having been bombed by those who have caused the death & maiming of children, has been forgiven by those who kept their lives in that Church.

“Our ability to give into these situations has been severely affected by those acting on the text threats of 2010. Even the former Trustee, who took on the Lease at Barry, has been affected by the witchcraft associated with these threats.

“We have had an eye-witness account given to us of ‘words from God’ flying around his ministry; & it is our experience that these words bring destruction in their paths, not only looking to destroy ministries such as ours, but we have had a further witness from Wales of premature deaths going on in relation to charismatic movements that embrace these ‘direction words from God’. Of course, the god being referred to here is not the God of the Bible, but from a god that masquerades himself as the God of the Bible; the one who comes to kill, steal & destroy; the one who declares himself to be ‘like the Most High.’

“The thief cometh not, but for to steal, and to kill, and to destroy: I am come that they might have life, and that they might have it more abundantly.”

[John 10:10]

“How art thou fallen from heaven,

O Lucifer, son of the morning!

how art thou cut down to the ground,

which didst weaken the nations!”

[Isaiah 14:12 AKJV].

“To sum up, therefore: we are asking the Vale of Glamorgan County Council, its government, its democratically elected councillors, to show us the old ‘law & justice in mercy’ so entrenched in the British Constitution; to understand that the Bible College of Wales that we embrace, that the principles of the Welsh revivals, of William Williams & Evan Roberts, be again prevalent in Welsh society.

“Even today, the cry from Cardiff on the day of the rugby match, is to be guided by the Great Jehovah; that we be fed by Him. But if this Council is to maintain its position that non-domestic rates are due on this property, on a property that has brought great loss to this Charity already, then one has to ask, where is the heart: in the ‘letter’ or in the spirit?

“If you answer ‘the letter’, then are you denying the very Constitution of Great Britain & the heritage of a land that is entrenched in Christian history, in a town called Barry that in itself has a statue of one bearing the title ‘Christian’, who gave so much to the town. “Is that town now looking to be part of this witchcraft move to ‘destroy us through official channels’ which was the threat given to us in 2010?

David P Griffiths

“P.S. If requested by the Council, a summary can be given of the official channel attacks against this ministry since 2010.

“We have survived all of these attacks, due to the dedication & commitment of Trustees.

“During one such attack, we can name one senior policeman who declared that we had done nothing criminally wrong, but ‘though we walk in high places, there are those in high places after us.’

“The effects of witchcraft in Wales needs to be understood, & realised not only in Christian circles, but across the whole of society. We can bear witness to so much being destroyed by threats like we received in 2010; & we ask councils throughout Wales to be kind to charities that bring forth life, rather than death.

“We are here to bring assistance to government. Indeed I, David Griffiths, have been voluntary Chair of Policy & Finance of one of Wales’ largest Town Councils; & it was a joy to see council funds going out to those bringing life to a community.

“I did not realise I would see a day when a Council would threaten legal action against a Charity whose members have chosen to give their lives for others, in the cause of bringing life.

“I believe this matter of how a charity can be charged non-domestic rates on a property it has not even entered, should be brought towards the Senedd, certain members of whom will be receiving a copy of this letter.

“It needs to be understood by the Vale of Glamorgan County Council, that we are here to help the Council in bringing understanding of a situation, the active Trustees of this Charity now based in Scotland, being over 65; other Trustees working amongst poor people overseas, & another Trustee giving into the persecuted Church in Asia.

“It is with this heart we ask your mercy, & for all the Councillors & Senedd members who receive this letter, we are prepared to give witness of all the legal threats instigated by those of witchcraft against us, so as to save others from the enormous stresses we have had to endure. That has been one of the reasons we have moved our College of Wales to Scotland, the land of its spiritual roots, where incidentally we have a shop on which we pay no non-domestic rates. For we are using the premises to bring life to others, which was our intention for the shop at Barry, but for the influences that affected our former Trustee.”

LETTER OF 03 12 18

03/12/2018 16:19:15

The Vale of Glamorgan Council

Business Rates Department

Civic Offices

Holton Road

BARRY

CF63 4HE

Dear Sir or Madam

Re. 50C Holton Road

BARRY

South Wales

CH63 4HE

Your Ref. 101543000

This property has remained empty for some time, the property being owned by Vincent Driscoll, and the above named Charity having leased it from him.

We understand every attempt is being made to re-lease the property.

We did not open it because our former trustee Clive Bate (who lives nearby) who had persuaded trustees to take on the property as a community outreach take-away suddenly resigned and walked out on us leaving us with the lease. The Charity is in process of making a full inquiry into this.

We are not receiving any income from the property, only expenditure, the inquiry looking into how we can solve this situation.

Our understanding is that as a registered charity we are not liable to business rates, and also I suspect that the property is empty doing no business.

If we can be of further assistance, please let us know.

Yours sincerely,

Rev David P Griffiths

Our reply to the summons has been open and transparent and we believe we are completely within the law to question the Council’s attempt to claim “non-domestic rates” for the reasons thus given.

Whilst presenting our position in relation to the “letter of the law” here, we ask you to consider the context of what has been a very bad experience for us all in Barry, and our belief based not primarily on emotional response but rather deep spiritual conviction that we have been set up here. This belief is thoroughly backed up by the threats we received in 2010 and consequent actions that have placed trustees under great stress, but not enough to stop us continuing to fulfil our stated purposes. Our witness statements we believe confirm that belief too!

We also ask you to understand that so many of our givers have passed away with the events of the last few years that includes in Scotland church going being banned for a time, an action found to be unconstitutional.

We are now living in a very divided nation, and it is our heart to unite it under our constitutional acts that allow freedom of expression, something the threats to destroy us have attempted to take away. We therefore present our case.

David P Griffiths on behalf of trustees.

We point out that Vale of Glamorgan Council have been kind to us and given us time to pay but

£6,020 - 84

must still be paid and so we would appreciate you taking this to our dear Lord Jesus - we forgive Clive Bate for getting us into this - he not replying to any of our mails for help.